I’m very happy to know that we found the best firm to handle this case!

— Client

The entire staff at Breit Biniazan provided excellent legal counsel and sound direction on which you can depend.

— G. Conklin

Made a big difference in our lives!

— Client

Breit Biniazan understood the stress that I was under and made things as smooth and easy as possible.

— Client

Don’t Settle, Hire the Best Trial Lawyers in the State

Best Personal Injury Lawyers in Virginia Beach

Breit Biniazan P.C. — Best Lawyers 2022

The Inner Circle of Advocates

Super Lawyers — Jeffrey A. Breit

Lawyer of the Year 2021 — Jeffrey A. Breit

Super Lawyers 2021 — Kevin Biniazan

Super Lawyers 2020 — Kevin Biniazan

Super Lawyers 2021

83% of our law firm attorneys are on the current 2021 Virginia List

Lawyer of the Year — Jeffrey A. Breit

Best Law Firms 2020

U.S. News selected our firm as one of the highest-rated, best performing law firms in the nation.

Who’s Who in American Law

A publisher that profiles attorneys who are considered leaders and influencers in American society for their noteworthy achievements.

Martindale-Hubbell Peer Review Rated

Martindale-Hubbell is a rating service that grades lawyers based on their integrity and skill. An AV Rating or higher indicates a high level of trustworthiness and effectiveness.

Super Lawyers

Super Lawyers selects the top 5% of practicing attorneys in the state for their history of results, legal reputation, and trial ability.

Litigator Award

Jeffrey Breit received the Litigator Award in 2014, which means he was ranked in the top 1% of all lawyers.

Virginia Business Legal Elite

The Virginia Business “Legal Elite” designation honors the most skilled and ethical attorneys in Virginia in a variety of practice areas.

AVVO Rating 10.0

AVVO is a rating system powered by legal colleagues and past clients who rate lawyers based on their effectiveness, skill, and ability to secure results. 10.0 is a perfect score

American Board of Trial Advocates

As members of the American Board of Trial Advocates, our lawyers actively seek to improve the practice of law as it affects our clients and their families.

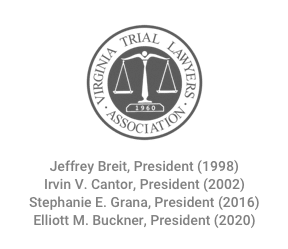

Virginia Trial Lawyers Association

Four of our firm’s partners have served or are serving as President of the 2,000-member VTLA, which seeks to uphold a high standard of legal practice while improving the fairness and quality of the law.

Best Law Firms 2019

U.S. News selected our firm as one of the highest-rated, best performing law firms in the nation.

Best Law Firms 2018

U.S. News selected our firm as one of the highest-rated, best performing law firms in the nation.

Best Law Firms 2017

U.S. News selected our firm as one of the highest-rated, best performing law firms in the nation.

Best Law Firms 2016

U.S. News selected our firm as one of the highest-rated, best performing law firms in the nation.

AAJ Master of Trial Law Jeffrey Breit

The Masters of Trial Law program honors AAJ Members who have shown dedication to their clients and commitment to the civil justice system through a rigorous curriculum of trial skills and legal specialty courses.